average stock price calculator india

Lot 1 60 shares costing 15 per share. Sum the amount invested and shares bought columns.

Stock Average Calculator Average Down Calculator

But you have faith that it will go upwards in future.

. Calculation remains the same even if you are carrying it on the short sold position instead of the buy position. To compute the average price divide the total purchase amount by the number of shares purchased to get the average price per share. Helping you invest at a right price and at the right time.

Here is how to calculate the average purchase price for any stock position. Now the stock price has gone down to 150. Then sold 7 3 so you got a newStock with stock waited average price is still new1 after that you.

To keep things consistent well use the average annualized returns of both the FTSE 100 and SP 500. If you buy a stock multiple times and want to calculate the average price that you paid for the stock the average down calculator will do just that. So now the cost price of the stock will rs 95 with a quantity of 2.

Divide the total amount invested by the total shares bought. Averaging into a position can drive to a much different breakeven point from the initial buy. Determining the right price of the stock ie.

151500000 150 Rs. The answer is to do some AVERAGING if the old average price is much higher than the new average price then it is a good buy since you are averaging down your stock price. Total number of contracts shares bought 1st contract amount 2nd contract amount 3rd contract amount.

Stock Average Price Total Amount Bought Total Shares Bought. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system wef. Here is some sample data.

If your query is still not resolved please raise a ticket here. Here comes this tool Share Average Calculator Stock Average Calculator by. Then add your investment in each stock eg 2500 invested monthly over 24.

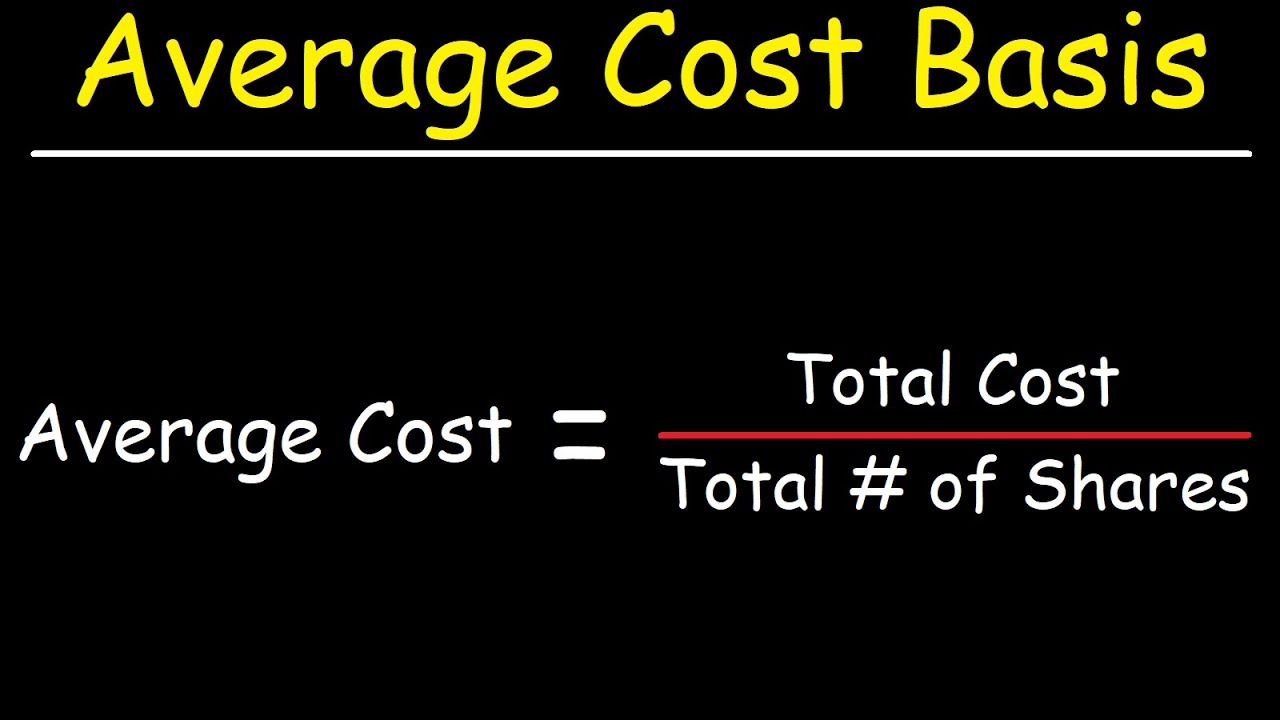

Fortunately you can calculate the overall dollar amount that youve invested in stock by following this formula. Heres a simple average cost calculation for XYZ stock holding with two separate lot purchases. I can calculate most things I need but Im struggling with Average Cost.

Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost. Average price Total Price Total Quantity Average price. Similarly using the same method you can find out the expected CAGR returns and enter that returns in stock return calculator instead of any random choice of yours to be on the better and rational side.

New Waited Average Price stok price 10 200 stock 10 new1. If you invest an initial lump of 5000 into a FTSE 100 index over 20 years and it continues to return an average of 775 per year our stock market calculator gives us a final balance of 22228. Computing the future dividend value B DPS A.

You want to reduce the average stock price by buying more stocks but you need to calculate how many stocks you need to buy to make the average closer to the current price. So XXX bought 100 at 1 then sold 50 at 2 so my average cost is 1. You can also figure out the average purchase price for each investment by dividing.

By providing valuation guidance in notes to valuation section. Total Amount Bought Shares BoughtPurchased Price 1st Shares BoughtPurchased Price 2nd Shares BoughtPurchased Price 3rd. PRICE CALCULATOR The Price Calculator would help you take right decisions while investing in stocks by.

This application allows to calculate stock average on entering first and second buy details. Stocks Under 1 2 5 10. The average price of Caterpillar stock would depend on the time frame one is calculating the price of Caterpillar stock.

Lets say you buy 100 shares at 60 per share but the stock drops to 30 per share. As pf July 12 2013 the price of Caterpillar stock was 8717 US Dollars. Calculating the Estimated stock purchase price that would be acceptable C B DRR001 SGR001 Then the following indicators are computed.

100000 100000 200000 contracts 2. 1010000 This is how the FIFO method is used for calculating the average price. First multiple the number of shares of each security you own by its market price at present.

Number of shares 60 40 100. It will help users to calculate prices for Nifty options Nifty Option calculator for Nifty Option Trading or Stock options Stock Option Calculator for Stock Option Trading and define. I have stock buysell transactions and want to calculate my position.

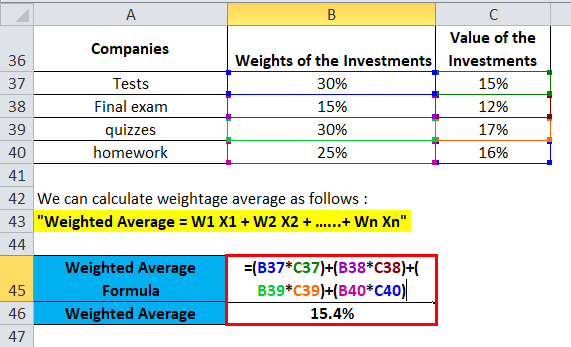

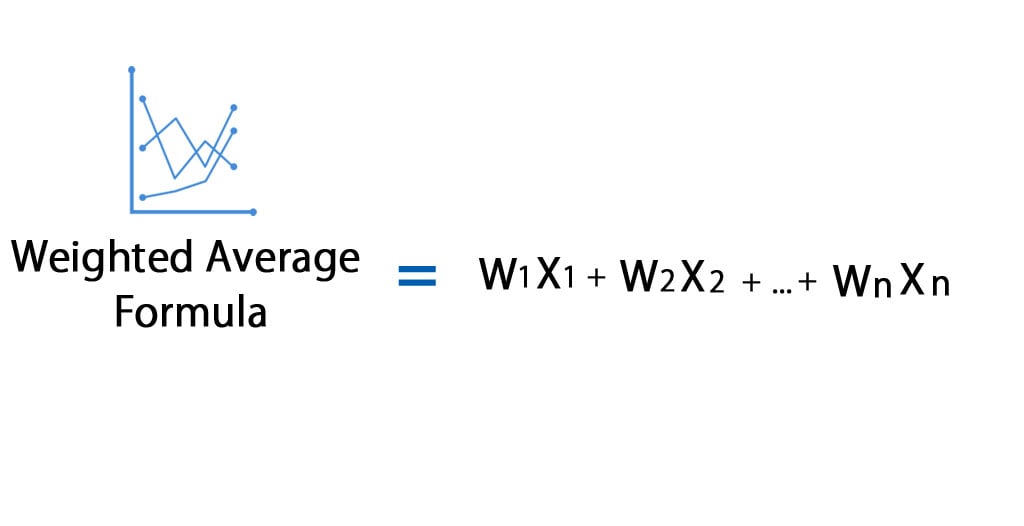

Update your mobile number email Id with your stock brokerdepository participant and receive OTP directly from depository on your email id andor mobile number to create pledge. Shares BoughtPurchased Price nth 3. To find the weighted average you multiply the number of shares by the price you paid for that transaction then add the number of shares you paid by the per-share price in your next transaction s and divide that number by your total shares.

1100100 19090 Hence total cost is rs 190 and total shares is. Lot 2 40 shares costing 18 per share. Volume 0 300000 500000.

Sharekhan Stock Market Online Share Trading Online. Then bought 100 at 2 and sold 100 at 3 so I have a Holding of 50. The algorithm behind this stock price calculator applies the formulas explained here.

When you buy a stock say at rs 100 and you re buy the same stock at rs 90 then the stock is valued at weighted average cost. May 2 2018. As you can see in the image above the investment worth is Rs2989 which is exactly the price at which the stock is currently trading the market.

Then you have bought 10 200 this must go as. You then buy another 100 shares at 30 per share which lowers your average price to 45 per share. Finding the growth factor A 1 SGR001.

In our example above wed start with 1000 X 10 10000 10 X 40 400 to get 1010 shares at a. To calculate the average price you need to know the total contracts shares quantity and the purchase price of each contract share. Below is a PSE Calculator that Ive created to save you the trouble of.

The SAMCO Options Price Calculator is designed for understanding purposes only. Its intention is to help option traders understand how option prices will move in case of different situations. Divide the total cost by the total number of shares to to calculate the average cost.

Stock Average Calculator Average Down Calculator

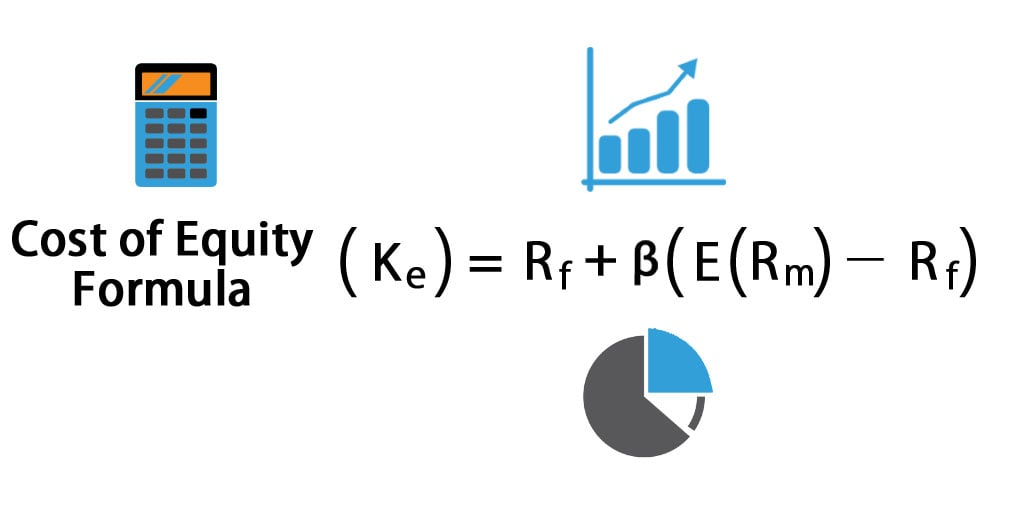

Cost Of Equity Formula Calculator Excel Template

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

Weighted Average Formula Calculator Excel Template

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Stock Average Calculator Average Down Calculator

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Weighted Average Formula Calculator Excel Template

How To Calculate The Weighted Average Trade Price The Motley Fool

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

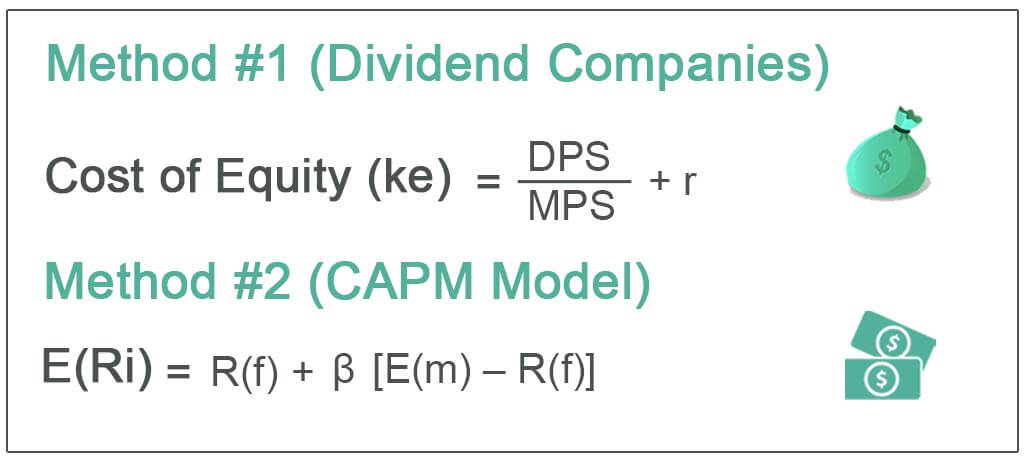

Cost Of Equity Formula How To Calculate Cost Of Equity Ke

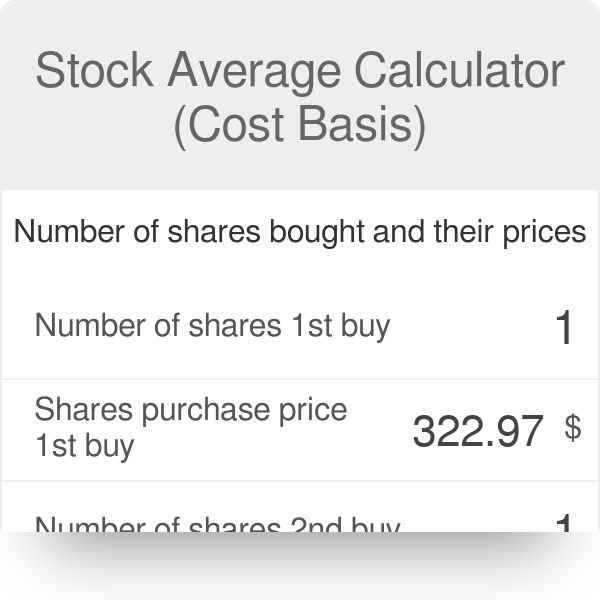

Stock Average Calculator Cost Basis

Book Value Formula How To Calculate Book Value Of A Company

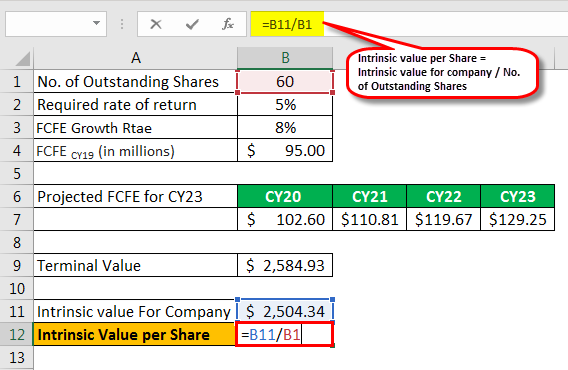

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Stock Average Calculator Cost Basis

How To Calculate Weighted Average Price Per Share Fox Business

How To Calculate Weighted Average Price Per Share The Motley Fool

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

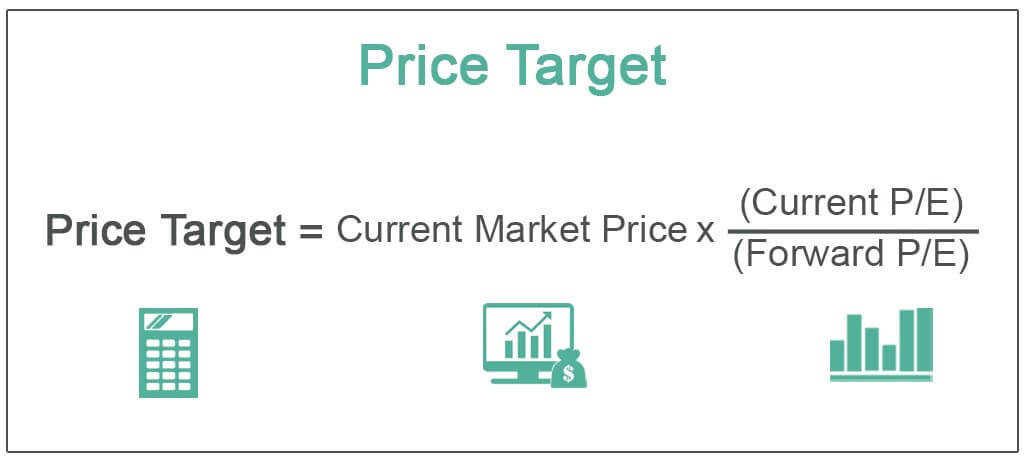

Price Target Definition Formula Calculate Stocks Price Target